The S&P 500 index mutual fund offered on your default company 401(k) retirement plan menu has long been one of your best investment options.

Even the worst company 401(k) retirement plan menus offer an S&P 500 index fund option. This fund option is as common as a money market or stable value mutual fund option.

Small cap funds, value funds, international funds, fixed income funds — none of them have been able to keep up with the S&P 500 investment performance over the last few years.

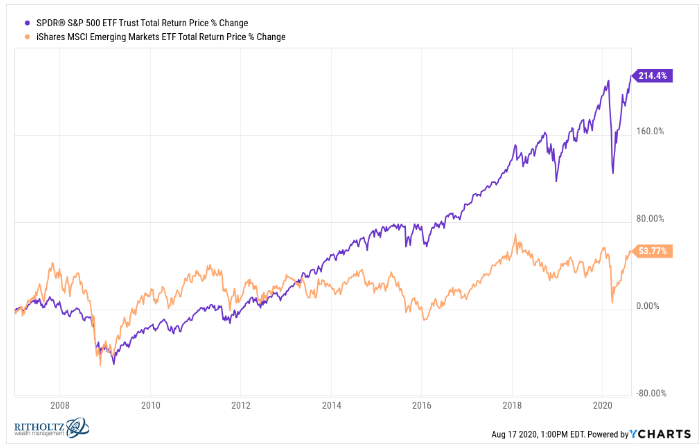

I wrote a blog post last week on the same topic. Here is another visual picture of the outperformance of the S&P 500 versus emerging market stocks since the start of 2007.

The S&P 500 index is trading near all-time high levels? Is your current company 401(k) retirement plan account balance near all-time highs now too?

Remember that one of the big reasons of the huge investment performance gap of the S&P 500 is due to the fact of the current capitalization of the index. Specifically, the S&P 500 index is currently hugely overweighted in large cap technology stocks.

Remember that the S&P 500 index is capitalization weighted. A good example to remember is the U.S. House of Representatives. The states with the larger population have more seats in the U.S. House.

The S&P 500 index works the same way. The largest market value stocks dominate the largest percentage of the index. Amazon, Apple, Microsoft, Facebook and Google currently make up around 23% of the S&P 500 index.

The importance of this handful of technology stocks brings up another very important investment management lesson for your company 401(k) retirement plan account.

How much of your company 401(k) account balance is directly invested in these stocks?

These large cap technology stocks also dominate the largest percentages of many Large Cap Growth and Mid Cap Growth mutual funds found on many company 401(k) retirement plan menus.

Google the name of the company 401(k) mutual funds you currently own. One of the top search results will most likely take you to the mutual fund fact sheet. That fact sheet will list the top ten stock holdings of that mutual fund. The sheet will also list what percentage of that mutual fund assets are invested in that stock,

If you find the technology stock names listed above, you guessed right in “what to buy?” in your company 401(k) account. If you don’t find these names, then ask yourself the following question.

If the objective of contributing and investing in your company 401(k) is to grow your retirement nest egg, then why don’t you own more of the mutual funds that own the best stocks available in your company 401(k) account?

A simple investment management question. The answer can make tens of thousands of dollars difference in your company 401(k) retirement plan balance.

Ric Lager

Lager & Company, Inc.