I currently provide company 401(k) retirement plan investment advice to several clients who work at large Fortune 500 companies. Several of these clients has reached out to me with questions regarding their latest and greatest company 401(k) retirement plan option.

There is an aggressive push on these accounts by company 401(k) retirement plan providers; the Schwab, Fidelity and Vanguard, etc. These professionally managed company 401(k) retirement plan accounts provide the individual company 401(k) retirement plan participant with an investment mix customized to their individual needs and long-term investment goals.

I have extensively reviewed the marketing material and legal disclosures on these accounts. These managed company 401(k) retirement plan account options are not without risks. Let me provide a plain English summary of my concerns.

All of these company 401(k) managed account providers offer the investment management services of an automated “robo-advisor” program. This program selects an asset allocation model for a participant’s 401(k) account based on answers to an online risk assessment questionnaire.

The program then suggests an allocation of the company 401(k) retirement plan account monies into a group of pre-established model portfolios of mutual funds. The theory behind these mutual fund choices is that each allocation best represents the individual company 401(k) retirement plan participant’s stock and bond market risk tolerance.

There is a significant cost for this managed company 401(k) account management services. The annual costs are calculated as a percentage of the individual company 401(k) retirement plan account value. This annual percentage fee is in addition to any trading costs or account maintenance costs charge by the company 401(k) retirement plan provider.

I have seen managed company 401(k) account costs range from 0.5% percent of portfolio assets to as high as 1.25%. Let me explain why these additional company 401(k) retirement plan account costs are a very dangerous proposition.

It is widely known that upwards of 85% of all mutual funds don’t outperform their benchmark stock market index. I have seen studies that report that same number as high as 92%.

If you add higher annual investment management fees on top of the current level of your annual company 401(k) retirement plan mutual fund costs, what is the likelihood that any mutual fund’s investment performance will be worth the additional costs?

Not very high in my opinion. And I have seen a mountain of independent studies to back me up.

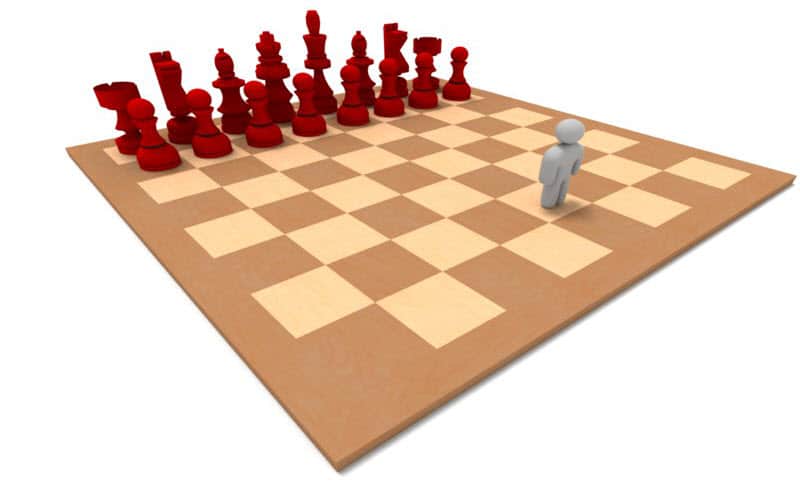

Individual company 401(k) retirement plan participants can’t assume that a robo-advisor managed account option will dramatically improve the long-term investment performance of their 401(k). Instead, the “customization” of a manage company 401(k) retirement plan account is most likely to be lost by the increased annual costs.

The challenge in managing a company 401(k) retirement plan menu is always “what to buy.” The best answer to that investment management question is to work with an independent, third-party investment advisor who is not affiliated with your company 401(k) retirement plan provider.

Managed company 401(k) retirement plan accounts generate additional revenue for your company 401(k) retirement plan provider. But that should not be one of your company 401(k) investment objectives.

Ric Lager

Lager & Company, Inc.